Revolutionizing insurance with faster engagement and sales process for Bancassurance Allianz Indonesia

Project Objective

The Allianz Bancassurance platform aimed to bridge the gap between insurance and banking services users by offering a user-friendly digital interface for selling insurance products. The primary goal was to streamline complex insurance workflows, making them more intuitive for sales person to explain products for both new and existing customers.

Challenges

Insurance processes can often seem overwhelming to users due to technical jargon, lengthy forms, and unclear navigation. The platform did not have competitors and references as much as commerce app. It was required a complete design overhaul to simplify processes and improve accessibility, ensuring users could easily explore and purchase insurance products without confusion or frustration.

Process and Approach

Research and Analysis

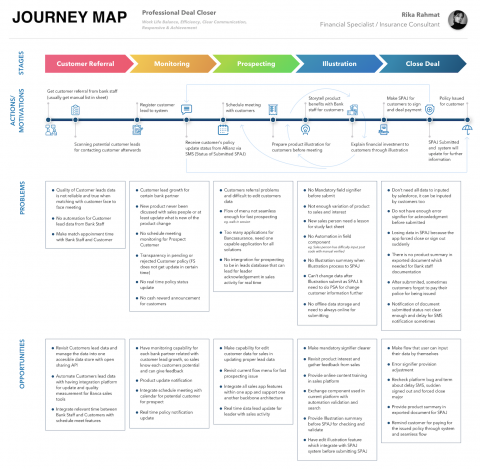

Through analysis and research, I identified two primary business goals: enabling quick generation of product quotations or illustrations and streamlining direct customer registration. From the user perspective, sales representatives sought faster deal closures to maximize bonuses. I engaged with both business stakeholders and users, uncovering key frustrations and aligning their expectations. This collaboration led to the creation of proto-personas that clarified the app's purpose and enhanced its usability.

To further explore product challenges and opportunities, I developed a high-level journey map outlining user interactions and pain points. This map not only informed the product roadmap but also aligned stakeholders, developers, and the product owner around a shared vision, ensuring clarity and fostering seamless collaboration.

In creating good product and prioritize development process, I also help and contribute to prioritize feature by value of the usage with my experience in UX Foundation and user 101 interview.

Wireframing and Prototyping

Using research findings, I developed wireframes that mapped out user-friendly workflows with MVP prioritization, ensuring seamless integration between banking and insurance services. Generating Illustration Feature for quoting insurance products with certain key features and track history in dashboard.

Testing and Iteration

Implementing high-fidelity designs is not always immediately ready for development. Before proceeding, The prototypes underwent multiple rounds of usability testing with diverse user groups. Feedback from these sessions highlighted opportunities for improvement, such as simplifying insurance terminology and improving mobile responsiveness. These insights guided iterative updates to the design.

Result and Impact

The new design of Allianz Bancassurance platform achieved notable success in improving user engagement and satisfaction. Key outcomes included:

- Simplified Navigation

Clearer workflows enabled users to complete tasks faster, reducing drop-off rates by 25%.

- Increased Trust

Enhanced transparency in insurance processes resulted in a 30% increase in user confidence and satisfaction scores.

- Boosted Conversions

Streamlined processes contributed to a 20% uptick in completed transactions, demonstrating the business value of a user-centered approach.

These results underscore the importance of aligning design solutions with user needs and organizational goals.

Conclusion

The Allianz Bancassurance project demonstrated the importance of aligning user-centered design with business objectives to create a seamless digital experience. By prioritizing collaboration with stakeholders and users, we addressed key pain points, streamlined workflows, and delivered a platform that meets both user needs and business goals.

Through iterative testing and refinement, the final solution not only enhanced usability but also provided clarity and direction for the product roadmap. This project reinforced the value of design in driving customer satisfaction, operational efficiency, and measurable business outcomes.